how much is a million dollar life insurance policy for a 50 year old woman

Heres when it could make sense for you. A 10-year 2000000 life insurance policy for 32 per month.

How Much Does A 1 000 000 Life Insurance Policy Cost

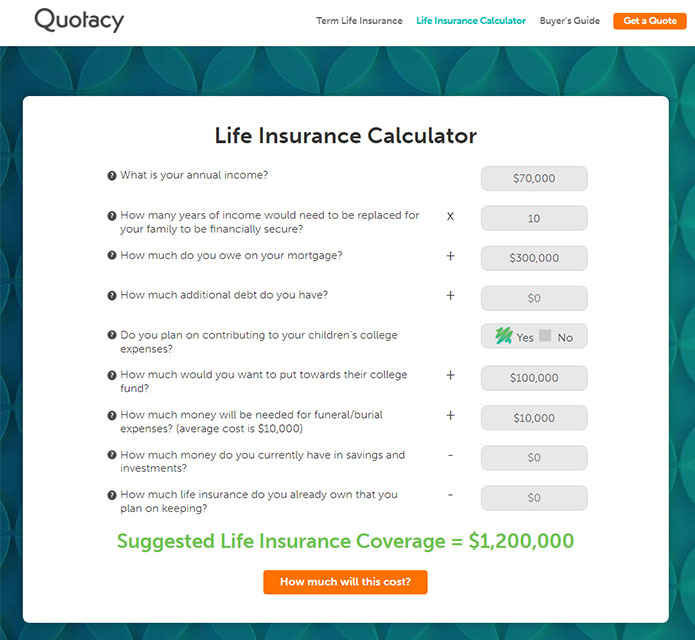

A healthy non-smoking 30-year-old woman can get 1 million coverage for as little as 34month with a 10-year term life policy.

. The money comes with no. Another option to get a million. How much youll end up paying will.

Guaranteed Issue Life Insurance 1M Cost. A 1 million life insurance can cost you from 30 to 50 per month depending on the number of years in your plan. Your recipient will get a one-million-dollar payment if you get million-dollar coverage.

A 1 million life insurance policy can cost on average as little as less than 45 per month especially if youre young and in good health. How much would a 2 million life insurance policy cost. The cost of a 1 million dollar term life insurance policy depends on age health term length and other factors.

11 rows To do this he requires a minimum 1 million dollar life policy to 15 million. There is an. How much is a million dollar life insurance a month.

Keep in mind large insurance policies in the range of. The two exceptions for 4 million of life insurance and 5 million of life insurance is for the 80 year old which is a guaranteed universal life quote which had to be quoted since. A 2-Million 20-year term life insurance policy costs as cheap as 1218 in annual premiums.

In the previous example prices went from approximately 12500 to 6500. Using Term Life Insurance as an example a 40-year-old male who is underwritten at the best possible rate class Preferred Plus could expect to pay 30 per month for 1 million in life. A healthy 50-year-old can get a policy for 101 per month for men and 81 per.

He can save money and still maintain good life insurance protection by buying the following policies. So this way you will be able to get a 1000000 whole life insurance without a medical exam. Plans with payments ranging from 10000 to 3 million can.

By comparison you might be able to get a million-dollar term policy. This is a difficult question to answer because so many variables are involved including the type of life insurance policy the age and health of the insured person and the. 50 per month or 12000 in.

Million Dollar Life Insurance Policy Payout. Just like it sounds this policy means your life insurance company will provide a 1 million cash payout to your beneficiaries if you die while the policy is active. And 30-year term costs 2050 a year.

Taken over the 15 insurance companies shown above the average cost for 20 years of coverage was. What is a million dollar life insurance policy. 30 per month or 7200 in total.

A million-dollar whole life policy often costs 800 a month or more even if you purchase the policy young.

Truth About The Million Dollar Life Insurance Policy With Rates Pinnaclequote

![]()

What Does A Million Dollar Life Insurance Policy Cost In 2020

Average Cost Of Life Insurance By Age Term Coverage Valuepenguin

What Does It Mean When A Life Insurance Policy Is Paid Up Life Ant

How Much Is Life Insurance In Canada Average Costs Policyme

How Much Is A Million Dollar Term Life Insurance Policy Top Quote Life Insurance

What Age Should You Buy Life Insurance Sbli

How Much Is Life Insurance In Canada Average Costs Policyme

Best Term Life Insurance Of November 2022 Forbes Advisor

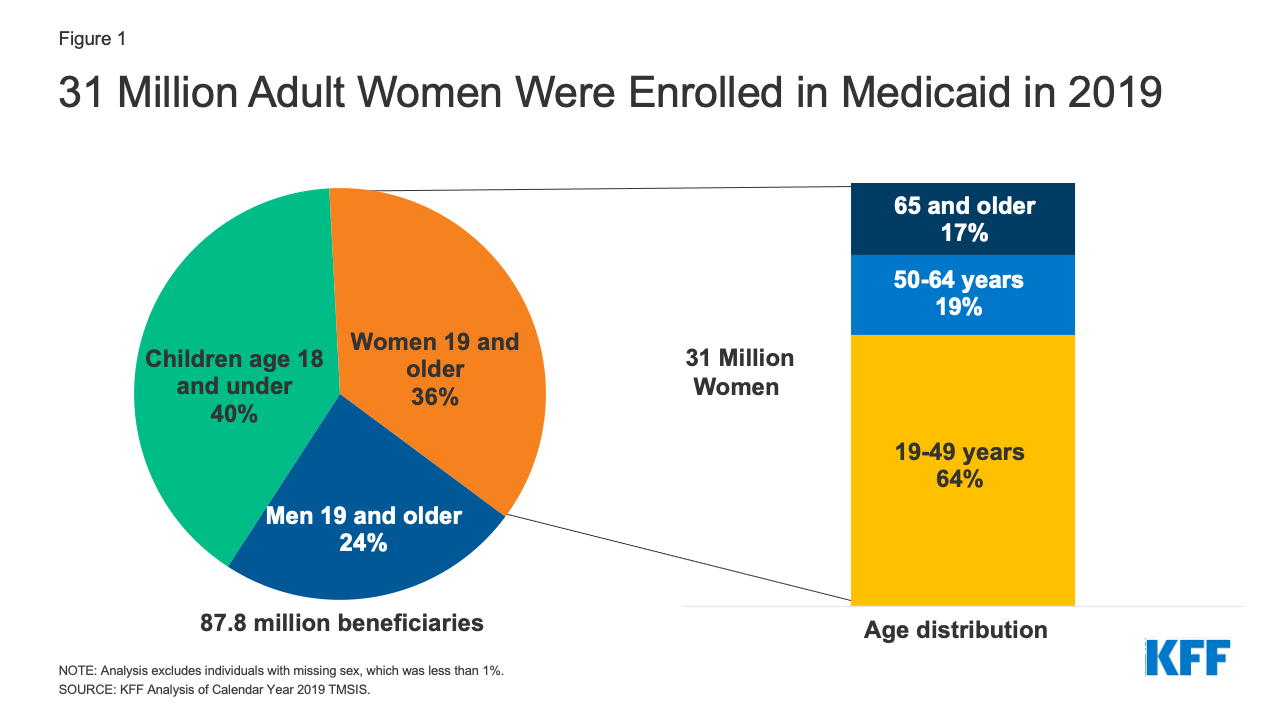

Medicaid Coverage For Women Kff

How Much Does A Million Dollar Life Insurance Policy Cost

How Much Is Life Insurance Average Costs Progressive

1 Million Life Insurance Policy Best Rates By Age Policymutual Com

![]()

What Does A Million Dollar Life Insurance Policy Cost In 2020

How Much Does A Million Dollar Life Insurance Policy Cost

Million Dollar Life Insurance Policy Term Life Ethos Life

10 Million Dollar Life Insurance Policy Cost Policymutual Com